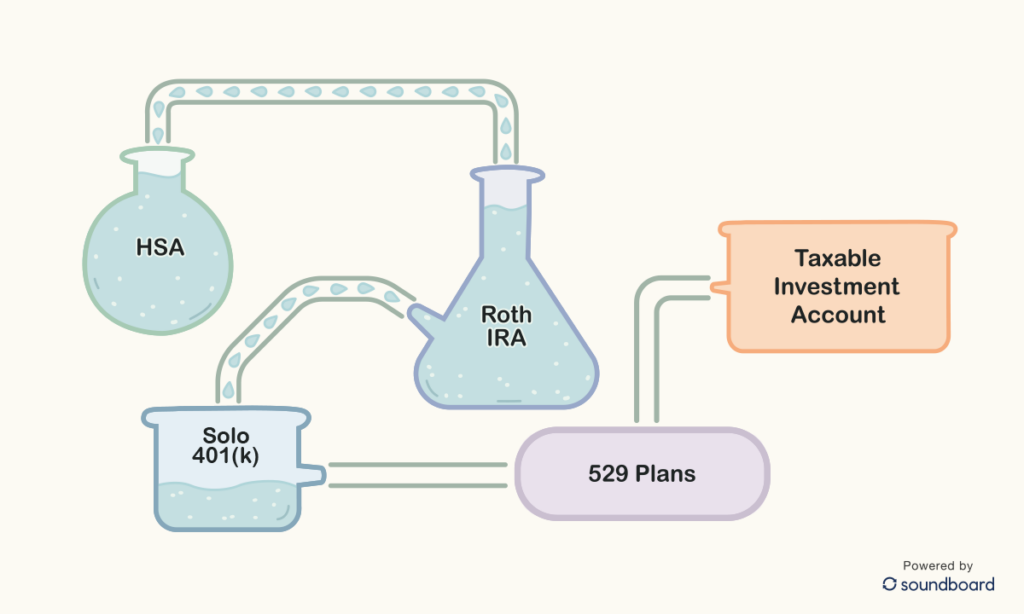

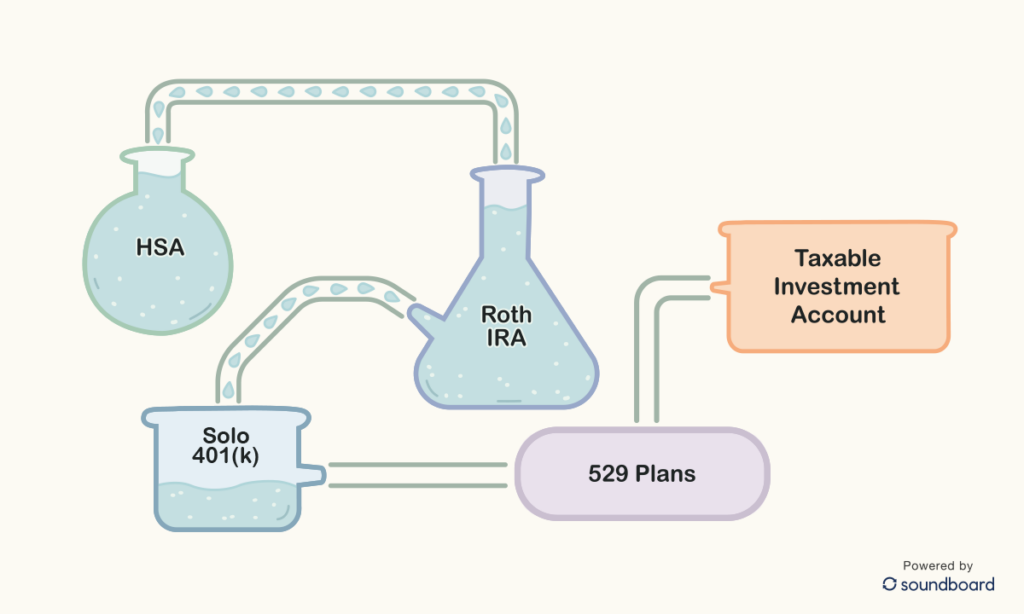

Tax-Advantaged Accounts for Self-Employed Professionals

Most self-employed professionals know about IRAs and 401(k)s, but not everyone knows which accounts to fund first or how to use them strategically. In this

Designed for the independent business owner, a solo practitioner’s roadmap to tax preparation.

Most self-employed professionals know about IRAs and 401(k)s, but not everyone knows which accounts to fund first or how to use them strategically. In this

Are your clients dealing with stress? Here are five ways you can help!

Has your back felt worse than ever as a remote worker? If so, we have some tips and tricks for you.

Should you hire a tax professional as a solo practitioner? Is it worth the money?

Tax tips from the Soundboard Team!

Why you should consider implementing a system in your business

A helpful resource to help you evaluate your pricing strategy and grow your business

Share this resource with your clients to help with interview tips and tricks

A solo-practitioners perspective on important topics to cover in an initial consultation

Explore a new approach to how artificial intelligence can generate student engagement