Is it worth the investment?

Deciding to hire a tax professional can be a big undertaking – we’re here to simplify the process. We will help weigh the benefits versus the costs of hiring tax help, so you can consider your specific circumstances within the framework. Ultimately, you will evaluate whether the benefit of support, expertise, and extra time in your pocket justifies the investment.

Tax laws are complex and ever-changing, so having the right help is key for your solo practice. This involves knowing what you need, who can help, and how to find them.

This article serves as that guide for solo practitioners. Together, we will walk through the process of deciding whether to hire a tax professional and outline the benefits, costs, and considerations involved in choosing the right expert to help you and your solo practice get your taxes done efficiently and correctly.

7 ways a tax professional can impact your solo practice tax experience:

A tax professional can provide support in several ways. Depending on who you hire and the services you hire them for, you can expect different levels of involvement and cost

The benefits of hiring a tax professional for their services are:

1) Expert Knowledge & Advice: Up-to-date understanding of tax regulations, and assistance with complex tax matters.

2) Time Savings: Frees you up to focus on your practice.

3) Reduced Errors: Minimizes mistakes that could lead to penalties.

4) Optimized Deductions: Ensures you claim eligible tax benefits.

5) Strategic Tax Planning: Advice on future tax savings.

6) IRS Audit Support: Representation and guidance, if audited.

7) Local Tax Expertise: Navigating state and local tax obligations.

Take a moment to consider what outcomes are most important to you: What services do you need, want, or can do without? Do you need traditional tax support or is your situation more complex?

Paying too much in self-employment taxes?

Paying too much in self-employment taxes?

The most common tax professionals: CPA, Tax Attorney, and EA

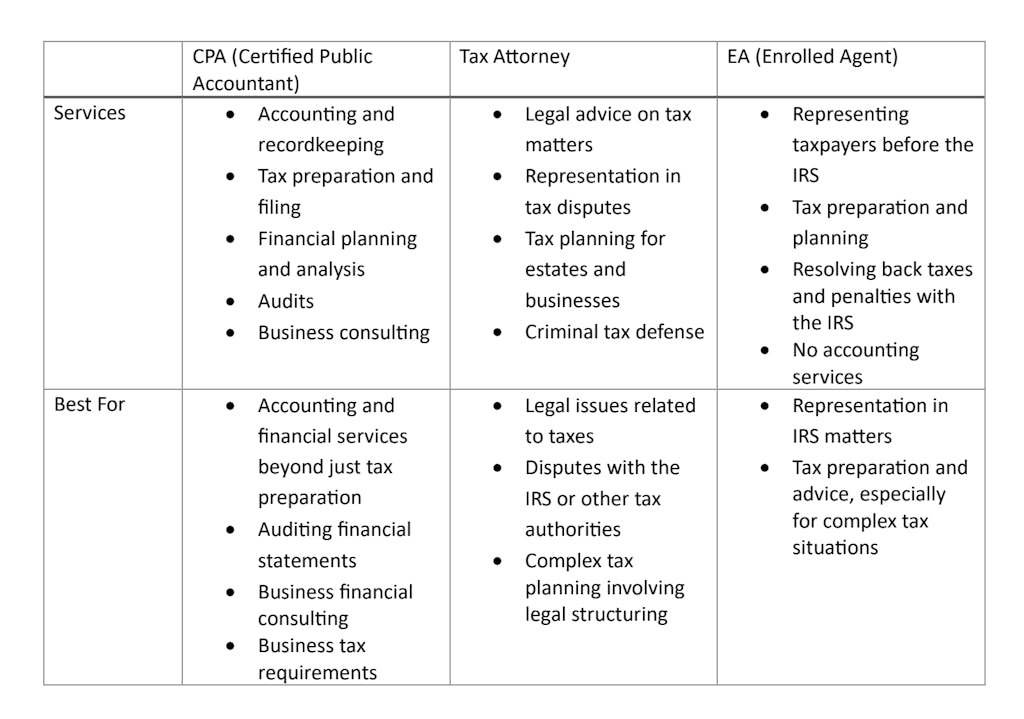

Let’s explore what kind of tax professional meets your solo practice’s specific needs. The primary types of licensed tax professionals hired by small businesses are: Certified Public Accountants (CPAs), Tax Attorneys, and Enrolled Agents (EAs).

- CPA: If you have no major complications with your business taxes, you are most likely to hire a CPA. A CPA is ideal for comprehensive tax and financial services, including audit representation and financial planning.

- Tax Attorney: If you are having trouble with the IRS or have complex tax issues, a tax attorney may be right for you. Best for complicated legal tax issues, dispute resolution and criminal tax defense.

- Enrolled Agent: EAs are federally recognized specialists in tax matters only (compared to a CPA who have expertise in accounting practices and are certified by their state board). Often EAs can be slightly more affordable than CPAs and Tax Attorneys but offer more narrow services.

Comparing tax professionals: Which is right for you?

Unsure what kind of tax professional you should hire, or curious about the similarities and differences? Refer to this side-by-side comparison:

Hint: Regardless of what type of tax professional, it is important that they are licensed and have expertise in small businesses/solo-practices.

What to look for when considering hiring a tax professional

Now that you’ve chosen the type of tax professional you are looking for, it is time to find the right one for you. Here is a simple process to help:

- Ensure all candidates have the necessary certifications

- Ask colleagues and friends for referrals

- Meet with a few potential tax professionals to discuss:

- Pricing and scope of work

- Filing process

- Working relationship and each party’s responsibilities

- Additional offerings

- Establish trust

Summary: You found a great tax pro to help

While reading this you thought about what you need from a tax professional, selected the best type of tax professional for your solo practice needs, and broke down the process of vetting a tax professional. We know that this is a daunting task, but hopefully, this guide can provide support while you look for the right tax professional for your solo practice.

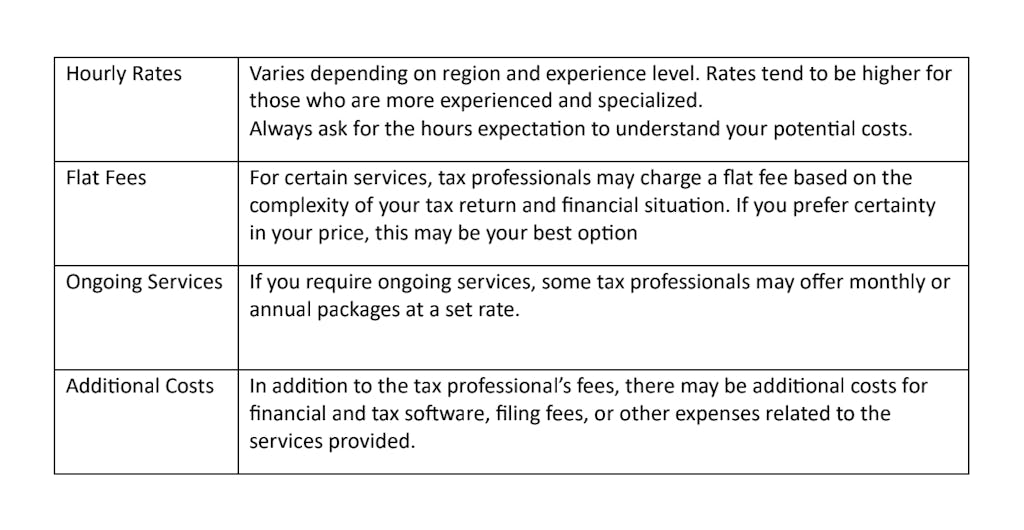

Bonus Section: Cost Structure

Interested in learning more about how tax professionals structure their working relationships? Reality is tax professionals charge in a variety of ways. Based on the support you need and your budget, it is important to understand your options and select what works best for you.