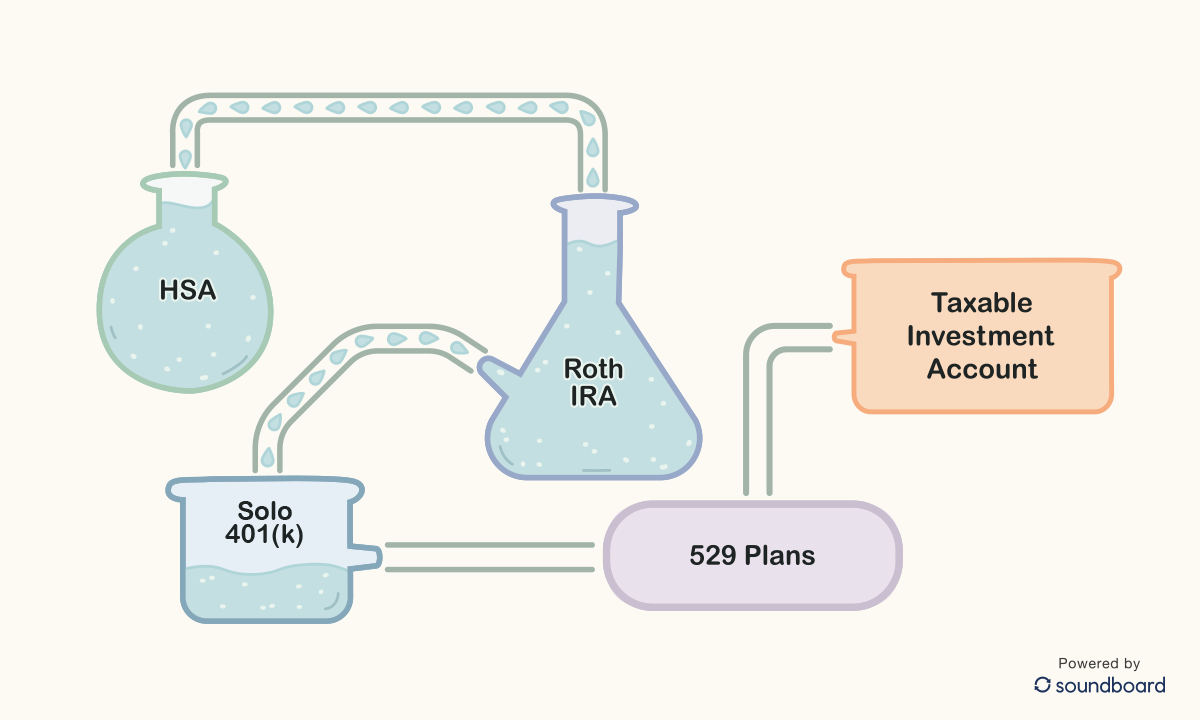

Most self-employed professionals know about IRAs and 401(k)s, but not everyone knows which accounts to fund first or how to use them strategically.

In this short article, we’ll cover:

- The benefits of each account (specifically for self-employed high-earners)

- Things to watch out for (common traps for sole-props / S-Corps)

- A few pieces of fun trivia about each account’s origin and backstory

HSA – The Only Triple-Tax Advantaged Account

Congress created the HSA in 2003. It’s widely recognized in tax circles that lawmakers didn’t fully grasp back then the massive benefit they were creating with this new account.

Why it’s so good?

- You can contribute with pre-tax dollars

- You can spend the money tax-free on qualified health expenses

- Your invested money grows tax-free (so it “snowballs” much faster)

- Not “use it or lose it” like an FSA

Criteria and how much to contribute:

- Can only open an HSA if your health insurance qualifies as “high-deductible health plan” (usually means lower monthly premiums and high deductibles)

- Can contribute up to $4,300 as individual or $8,550 as family per year (2025)

Things to look out for as self-employed:

- If you’re a W-2 employee, HSA contributions come straight out of your paycheck (similar to a 401k), so you don’t pay income tax or payroll/FICA tax

- If you’re self-employed (sole prop/LLC, or S-Corp), you don’t get that direct payroll option in the same way, so the contribution will be after tax (incl. income taxes and FICA taxes)

- BUT the good news is that the government “returns” the income tax portion at the end of the year when you take the HSA deduction on your Form 1040

Roth IRA – “Pay Tax Now and Never Pay Again”

Named after Senator William Roth in 1997, who said Americans should be able to build something truly their own – “untaxed, untouched, and available when they need it.”

Why we like it?

- Contribute after-tax dollars, but money grows tax-free

- If you follow the rules, can withdraw everything 100% tax-free after age 59 1/2

- If needed before age 59, you can pull out the original “investment” with no penalty (but you have to leave any of the “gains” in the account)

Criteria:

- 2025 annual limit of $7,000 (or $8k if age 50+)

- If you make more than a certain amount ($150k single, $236 MFJ), contribution of $7k starts to phase out

- If you’re above the income limit above, can still easily contribute using Backdoor Roth strategy

When to prioritize Roth over a traditional 401(k)?

- If you expect to be in a higher tax bracket later in life — especially if you’ll have strong passive income (real estate, investments, etc.)

- If you think tax rates will rise in the future and want to lock in today’s rates

- Roth IRA is one of the few accounts with no required withdrawals in retirement, so the money can keep growing tax-free for as long as you leave it

Solo 401(k) – “The Biggest Pool You Can Tap”

In 2022, Congress passed SECURE Act 2.0, which added strong incentives for this account. One of them: if you set it up with automatic contributions (e.g., ~3% of your paycheck going straight to the account), you can claim a $1,500 tax credit.

Why high-earning independents love it:

- It has the highest contribution limit of any retirement account (up to $70k per year)

- Contributions reduce your taxable income today (giving you one of the cleanest ways to reduce taxable income)

Criteria:

- For 2025, can contribute up to $70k (or $77.5k if age 50+)

- Up to $23.5k of your salary can be contributed directly as the “employee”

- As the employer, you can contribute up to 25% of your W-2 (or ~20% of adj. net income if you’re a sole prop)

Example to achieve a ~$55k contribution for a Sole-Proprietor:

- You generate $173k in Schedule C net income

- You can contribute $23.5k as the “employee”

- You contribute $32k as the “employer” (~20% of net earnings after ½ SE tax deduction)

In this case, assuming a 22% federal and 5% state income tax rate, contributing ~$55k to a Solo 401(k) could save you approximately $15k in income taxes.

We know setting up new accounts can be a bit daunting, but it’s worth putting in the time to getting it right. Time flies, and all the tax savings and investment gains really do snowball over time.

More soon. Until then, hope this gives you a little more clarity around where your next dollar should go.

-The Soundboard Team

The information shared in this article is provided for general educational purposes and should not be considered personalized tax, legal, or financial advice. Please consult a qualified professional before making decisions based on your unique circumstances.